BOI Informational and Step-by-Step Filing Guide

What is this new filing?

Following the passage of the Corporate Transparency Act certain US and foreign entities are now required to report beneficial ownership information (BOI) to the Financial Crimes Enforcement Network (FinCEN), a division of the US Department of the Treasury. This BOI information is reported to FinCEN via Beneficial Ownership Information Reports (BOIRs). This filing guide is designed to provide a step-by-step explanation of the who, what, when, and how of filing a BOIR.

Who must file?

An entity is required to file a BOIR if they are considered a “reporting company” that does not qualify for an exemption. There are two categories of reporting companies: a “domestic reporting company” and a “foreign reporting company”. If your company is neither a “domestic reporting company” nor “foreign reporting company” because it does not meet either definition or it qualifies for an exemption, then it is not required to file a report.

The best resource for determining if your entity is considered a “reporting company” and/or whether you qualify for an exemption is by reviewing FinCEN’s Small Business Compliance Guide found at www.fincen.gov (a full URL is included at the end of this report). Below is a flowchart from the Small Business Compliance Guide to help determine if you are required to file:

Things to Note Regarding Who Must File:

The following bullet points outline some of the most common exemptions and important points in determining whether you must file:

Sole proprietorship is NOT a reporting company unless it was created in the US by filing a document with the Secretary of State or similar office

A corporation treated as a pass-through entity under subchapter S (“S-Corp”) that qualified as a reporting company because it is created/registered with Secretary of state and that does not qualify for an exemption MUST comply with reporting requirements. The entity’s S-Corp pass-through structure does not affect BOI reporting obligations.

If a domestic corporation or LLC is NOT created by filing a document with Secretary of State or a similar office, it is NOT a reporting company.

Special rules apply to HOAs depending on how the HOA was created and what form it has taken, it is advised to review the applicable information in the BOI FAQ on the FinCEN website.

For information on other circumstances, entities that are winding up, entities that have converted into another corporate type, and foreign companies that have ceased doing business in the US, see the BOI FAQ (link at end of report).

When should a BOIR be filed?

FinCEN began accepting BOIRs electronically on January 1, 2024. The deadline for filing reports is currently stayed due to a federal court order but companies can still file their BOI reports if they desire to do so.

If there is any change to or an inaccuracy is identified in the required information about a reporting company and/or its beneficial owners in a BOIR that a reporting company filed, an updated BOIR should be filed no later than 30 days after the date on which the change occurred.

If there is any change to or an inaccuracy is identified in the required information about a reporting company and/or its beneficial owners in a BOIR that a reporting company filed, an updated BOIR should be filed no later than 30 days after the date on which the change occurred.

What is BOI?

Per the US Department of Treasury: “Beneficial ownership information is information about an entity, its beneficial owners and, in certain cases, its company applicants.”

Who is a beneficial owner?

A beneficial owner is any individual who, directly or indirectly:

Exercises substantial control over a reporting company

OR

Owns or controls at least 25% of the ownership interests of a reporting company

An individual might be a beneficial owner through substantial control, ownership interests, or both. Reporting companies are not required to report the reason (i.e., substantial control or ownership interests) that an individual is a beneficial owner, and a reporting company can have multiple beneficial owners.

It is expected that every reporting company will be substantially controlled by at least 1 or more individuals, therefore every reporting company should be able to identify and report at least 1 beneficial owner to FinCEN. Any individual who qualifies as a beneficial owner should report the required information about that individual to FinCEN in the reporting company’s BOIR. For a detailed guidance in determining who meets the requirements of being a beneficial owner, it is recommended to consult the Small Business Compliance Guide (Pgs. 19-28). Below is a summary of the important terms, requirements, and rules:

Substantial Control – all individuals that exercise substantial control are required to be reported. An individual exercises substantial control over a reporting company if he individual meets any of the 4 criteria:

The individual is a senior officer (president, CFRO, GC, CERO, COO, or any other officer performing a similar function).

The individual has authority to appoint or remove certain officers or a majority of directors of the reporting company.

A member of a company’s board of directors is not automatically a beneficial owner. Whether a particular director meets any of the criteria is a question that the reporting company must consider on a director-by-director basis.

The individual is an important decision maker and/or has substantial influence over important decides pertaining to the company’s business, finances and/or structure.

The individual has any other form of substantial control over the reporting company.

Ownership Interest – all individuals who own or control at least 35% of the ownership interests of the company must be reported. Any of the following may be an ownership interest:

Equity, stock or voting rights

Capital or profit interest

Convertible instruments

Options or other non-binding privileges to buyer or sell

Any other instrument, contract or other mechanism used to establish ownership

Steps to Identify Beneficial Owners:

Step 1: Identify individuals who exercise substantial control over the company.

Individuals can directly or indirectly exercise substantial control. This control can be exercised via contracts, arrangements, understandings, relationships, or otherwise. A substantial control questionnaire is included in the Small Business Compliance Guide on pg. 20.

Note for Trusts: a trustee of a trust or similar arrangement may exercise substantial control over a reporting company.

Step 2: Identify the types of ownership interests in your company and the individuals that hold those ownership interests.

Individuals may directly or indirectly own or control ownership interests. Individuals can own/control ownership interests through contracts, arrangements, understandings, relationships, or otherwise. An ownership interest questionnaire is included in the Small Business Compliance Guide on pg. 22.

Note for Trusts: Certain individuals may hold ownership interests through a trust or similar arrangement:

A trustee or other individual with the authority to dispose of trust assets.

A beneficiary who is the sole permissible recipient of trust income and principal or who has the right to demand a distribution of or withdraw substantially all of the trust assets.

A grantor or settlor who has the right to revoke or otherwise withdraw trust assets.

Step 3: Calculate the percentage of ownership interests held directly or indirectly by individuals to identify who own or control, directly or indirectly, at least 25% of the ownership interests of the company.

In calculating the percentage of ownership interests assume that any options, privileges, or convertible instruments have been exercised/converted.

If your company issues shares of stock, is a corporation (including S-Corp), or is not a corporation but is treated as one for federal income tax purposes: calculate each individual’s ownership interest as a percentage of the total shares of stock issued. If some shares have more voting power or represent more of the value of the company than other shares use the following 2 calculation methods. The individual’s ownership interest will be the larger of the two percentages:

Total combined voting power of all classes of the individual’s ownership interests + Total outstanding voting power of all classes of ownership interests entitled to vote = Individual’s voting power %

Total combined value of the individual’s ownership interests + Total outstanding value of all classes of ownership interests = Individual’s ownership interest value %

If your company, including if your company is treated as a partnership for federal income tax purposes, issues capital or profit interests apply the following calculation:

Individual’s capital and profit interests + Total outstanding capital and profit interests = Individual’s capital and profit interests %

Exceptions from the Beneficial Owner Definition

When an individual who would otherwise be a beneficial owner of a reporting company qualifies for an exception, the reporting company does not have to report that individual as a beneficial owner in its BOI report to FinCEN. There are 5 primary exceptions to the definition of beneficial owner:

Minor child, as defined under the law of the state or Tribe in which the reporting company is created or the foreign reporting company is first registered.

Nominee, intermediary, custodian, or agent

Employee: (1) subject to the employer’s control and discharge; (2) substantial control over, or economic benefits from, the company are derived solely from the status of the individual as employee; and (3) the individual is not a senior officer of the reporting company.

Inheritor: individual’s only interest in the reporting company is a future interest though a right of inheritance.

Creditor

Special Note for Accountants and Lawyers:

Accountants and lawyers are generally not beneficial owners, but it depends on the work they’re performing. Those that provide general accounting or legal services are not considered beneficial owners because their services do not deem them to be in “substantial control.” A lawyer or accountant who is designated as an agent of the reporting company may qualify for the “nominee, intermediary, custodian, or agent” exception from the beneficial owner definition. An individual who holds the position of general counsel in a reporting company is a “senior officer” of that company and is therefore a beneficial owner.

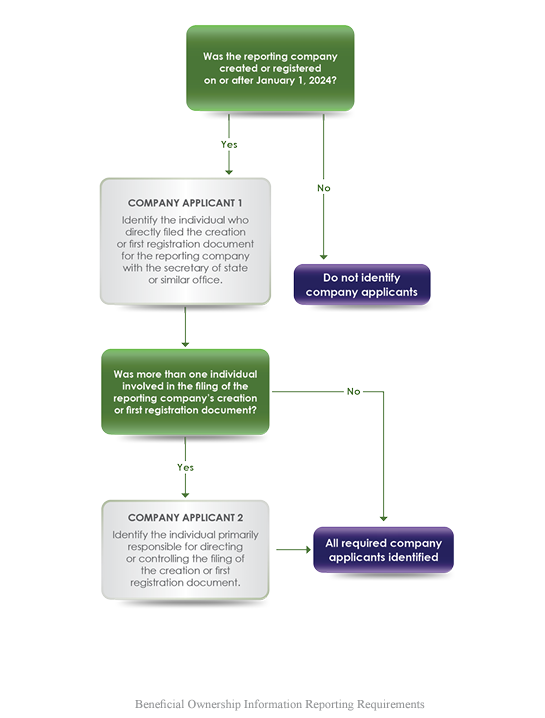

What is a company applicant and when must they be reported?

A company applicant is an individual who directly files or is primarily responsible for the filing of the document that creates or registers the company.

If your company was in existence prior to January 1, 2024, you do not have to provide information for company applicants.

If your entity is a domestic or foreign reporting company, created or registered on or after January 1, 2024, you will need to provide information regarding the entity’s company applicants. You will need to provide the applicant’s name, date of birth, address, and proof of an ID. An acceptable identification document, like a driver’s license or passport, will need to be uploaded.

A company applicant can be either (a) the direct filer or (b) the individual who directs or controls the filing action.

Direct Filers: This is the individual who directly filed the document that created a domestic reporting company, or the individual who directly filed the document that first registered a foreign reporting company. This individual would have actually physically or electronically filed the document with the secretary of state or similar office. They must be reported by all reporting companies with an applicant reporting requirement.

Directs or Controls the Filing Action: This individual is a company applicant even though the individual did not actually file the document with the secretary of state or similar office. If more than one person was involved, then 2 applicants must be reported. This category only has to be reported when more than one individual is involved in the filing of the document that created or registered the company.

No reporting company will have more than 2 company applicants.

A flowchart to help determine whether your company needs to report company applicants and aid in identifying those company applicants is included below.

What Information Needs to be Reported?

The following is a checklist to help identify the info about your company and its beneficial owners/company applications that should be collected and reported.

Reporting Company

Full legal name

Any trade name or “doing business as” (DBA) name

Complete current US address – should be the principal place of business in the U.S., cannot be a PO Box

State, Tribal, or Foreign jurisdiction of formation

Foreign Reporting Company Only: state or tribal jurisdiction of first registration

Internal Revenue Service (IRS) Taxpayer Identification Number (TIN) (including an Employer Identification Number (EIN))

[for foreign reporting company that has not been issued a TIN, report a tax identification number issued by foreign jurisdiction and the name of such jurisdiction]

Each Beneficial Owner and Company Applicant

Full Legal Name

Date of Birth

Complete current address – should be a residential street address, except for those who form/register a company in the course of their business (i.e., paralegals)

Unique identifying number and issuing jurisdiction from, and image of, one of the following non-expired documents:

US Passport

State Driver’s License

Identification document issued by a state, local government, or tribe

If an individual has NONE of the above, a foreign passport

What is a FinCEN ID?

A FinCEN ID (or FinCEN identifier) is a unique identifying number that FinCEN will issue to an individual or reporting company upon request after the individual or company provides FinCEN with certain information. A FinCEN ID can be used in place of the required information above when submitting a BOIR. It’s likely that you will not have a FinCEN ID. If you do not – an acceptable identification document is required for reporting.

An individual or reporting company is not required to obtain a FinCEN identifier.

An individual or reporting company may only receive one FinCEN identifier.

Your company may include FinCEN identifiers in its BOI report instead of certain required information about beneficial owners or company applicants.

If your company does not have a FinCEN ID and would like to receive one, you can request one by checking a box on the reporting form. The ID will be provided in the submission confirmation details after the BOI report is submitted/accepted.

Individuals may electronically apply for FinCEN identifiers. Upon application, the identifier will immediately be provided.

If the company applicant has a 12-digit FinCEN ID, enter it in the FinCEN ID field. After a valid FinCEN ID has been entered, all remaining fields for the company applicant will be cleared and disabled. You will not have to enter an acceptable identifying document for a company applicant.

Special Reporting Rules

Owned by an exempt entity - You do not need to report information about any beneficial owner whose ownership interests in a reporting company are held through one or more entities, all of which are themselves exempt from the reporting company definition. If this rule applies, then you can report the name of all of the exempt entities instead of information about the individual who is a beneficial owner.

Minor child - You do not need to report information about a beneficial owner who is a minor child, provided you have reported the required information about the minor child’s parent or legal guardian. If this rule applies, you may report the required information about the child’s parent or legal guardian instead of the child.

Foreign pooled investment vehicle - You do not need to report information about each beneficial owner and company applicant if your company was formed under the laws of a foreign country and would be a reporting company if not for the pooled investment vehicle exemption. If this special rule applies, you must report one individual who exercises substantial control over the company. You do not need to report any company applicants. If more than one individual exercise substantial control over the company, you must report information about the individual who has the greatest authority over management of the company.

Company applicant reporting for existing companies - If the reporting company was created or registered before January 1, 2024, you do not need to report any company applicant information for the reporting company. If this special rule applies, do not report company applicants. Specify on the BOIR that the company was created or registered before January 1, 2024.

Filing a BOIR via the FinCEN E-Filing System:

Step 1: Ensure you have the required information for both the reporting company and the beneficial owners/company applicants as specified above.

Step 2: Access the filing portal. Go to https://boiefiling.fincen.gov/ It is recommended to use Microsoft Edge or Google Chrome.

Step 3: Start the filing process > Select File BOIR link/icon.

Step 4: Select File Online BOIR as the filing method. Click Prepare & Submit BOIR button under File Online BOIR section.

Step 5: Review the warning language and click the I Agree button.

Step 6: Fill out the Form. Use the tabs to navigate the online BOIR or by click the Next button in the bottom right corner. The selected tab is highlighted in blue.

Step 7: Complete the Filing Information tab. Complete all required red asterisk (*) fields.

Select the Type of Filing you wish to make. Only one option can be selected.

Initial Report - first time filing a BOIR, when this is selected no further information is required in this section.

Corrected Prior Report, Update Prior Report, or Newly Exempt Entity is selected – must complete the Legal Name, Tax Identification Type, and Tax Identification Number fields with the reporting company information from the company’s most recently filed prior BOIR.

Date Prepared – automatically filled with the current date.

Once all required fields are completed, click Next or navigate to the next tab.

Step 8: Complete the Reporting Company tab. Complete all required red asterisk (*) fields under the Reporting Company tab. (1 of 3)

Request to Receive FinCEN ID – Select Request to receive FinCEN ID to receive a unique FinCEN identifier for the reporting company. The FinCEN ID will be provide in the submission confirmation details provided to the filer directly after the BOIR is submitted/accepted.

Select Foreign Pooled Investment Vehicle option if the reporting company is a foreign pooled investment vehicle. If this option is selected, Company Applicant information is no longer required and is cleared/disabled.

Note: Only one (1) beneficial owner must be reported under the Beneficial Owner(s) tab in this situation.

Step 9: Complete the Reporting Company tab. Complete all required red asterisk (*) fields under the Reporting Company tab. (2 of 3)

Name and Alternate Name(s) – Complete the fields under the Legal Name and alternate name(s) section as applicable.

to add more than one alternate name for the reporting company, click Add Alternate Name button to add additional alternate reporting company names.

Tax Identification Type – Select the Tax Identification Type dropdown menu and enter the Tax Identification Number in the appropriate blank. EIN, SSN/TIN, or Foreign may be picked. If Foreign is selected, the Country/Jurisdiction field must be filled in.

Note: An EIN or SSN/TIN is required unless a foreign reporting company does not have one. In this instance, the foreign reporting company may report its foreign tax identification number and the issuing jurisdiction.

Step 10: Complete the Reporting Company tab. Complete all required red asterisk (*) fields under the Reporting Company tab. (3 of 3)

Select the Country/Jurisdiction of Formation dropdown menu.

If United States is selected > Then State of Formation and Tribal Jurisdiction of Formation fields appear. One of these fields must be completed.

.If a US Territory is selected > Then State of Formation filed appears and is automatically populated with that US Territory

If a Foreign Country is selected> Then State of First Registration and Tribal Jurisdiction of First Registration fields appear. One of these fields must be completed.

Complete all fields under the Current US Address section. Select US or US Territory from the dropdown menu. If US is selected, the state dropdown must be completed. If US Territory is selected, the State field is automatically populated with that US Territory.

Once all blanks are completed on the Reporting Company tab, click Next or navigate to the next tab.

Step 11: Complete the Company Applicant(s) tab. Complete all required red asterisk (*) fields under the Company Applicant(s) tab. (1 of 4)

Existing Reporting Company - Select the Existing Reporting Company checkbox if the reporting company was created/registered before January 1, 2024.

When Existing Reporting Company is selected, Company Applicant Information is NOT required, and the fields are cleared and disabled.

Nothing is required to be entered on this tab when Existing Reporting Company is selected. Click Next to move to the next tab.

Step 12: Complete the Company Applicant(s) tab. Complete all required red asterisk (*) fields under the Company Applicant(s) tab. (2 of 4)

If Existing Reporting Company is NOT checked, the Company Applicant(s) tab will need to be completed for each Company Applicant.

Company Applicant FinCEN ID – If the company applicant has a 12-digit FinCEN ID, it should be entered here. When a valid FinCEN ID has been entered, all remaining fields of company applicant will be cleared/disabled as the required information is already connected to the FinCEN ID. It is likely that your company applicant will NOT have a FinCEN ID. This is OK. The remaining fields on the Company Applicant(s) tab will just need to be filled out.

*Steps 13 and 14 are required for company applicants who DO NOT have a FinCEN ID.

Step 13: Complete the Company Applicant(s) tab. Complete all required red asterisk (*) fields under the Company Applicant(s) tab. (3 of 4)

Enter the company applicant’s information in the Legal Name and Date of Birth and Current Address sections. For a company applicant who forms/registers entities in the course of their business, report the street address of such business; for all other company applicant’s report the residential address.

Step 14: Complete the Company Applicant(s) tab. Complete all required red asterisk (*) fields under the Company Applicant(s) tab. (4 of 4)

Enter the company applicant’s information under Form of Identification and Issuing Jurisdiction section. You will also need to attach an image of an acceptable identifying document for the company applicant. The image must be complete, clear and readable image of the page/side of the identifying document containing the unique identifying number and other identifying data. Only 1 file with a maximum file size of 4MB may be attached. Supported formats: JPG, JPEG, PNG, and PDF.

Once completed click the Next button.

Step 15: After providing the required information for a company applicant, click the Add Company Applicant button to add an additional company applicant if required.

An additional company applicant section (i.e., Company Applicant #2) will be added under the first company applicant section (i.e., Company Applicant #1). Click the Remove Company Applicant button to remove a company applicant.

Note: Reporting Companies may be required to report up to two (2) company applicants.

Once Completed click Next or navigate to the Beneficial Owner(s) tab.

Step 16: Complete the Beneficial Owner(s) tab. Complete all required red asterisk (*) fields under the Beneficial Owner(s) tab. (1 of 3)

If applicable, enter the 12-digit FinCEN ID of the beneficial owner. It is more likely than not that your beneficial owners will not already have a FinCEN ID, this is OK. You will just need to complete all fields on the Beneficial Owner(s) tab. If a valid FinCEN ID is entered, the Parent/Guardian information instead of minor child checkbox will remain available to select, all other fields will be cleared/disabled as the information is already connected to the FinCEN ID.

The Exempt entity box applies to 23 different entities. These entities are listed out and the exemption requirements for each is included in the Small Business Compliance Guide (pgs. 4-9). Unless you qualify for one of these exemptions, leave this box blank.

The Steps 17 and 18 apply if you DO NOT have a FinCEN ID.

Step 17: Complete the Beneficial Owner(s) tab. Complete all required red asterisk (*) fields under the Beneficial Owner(s) tab. (2 of 3)

Fill out the Name, Date of Birth, and Residential Address sections. PO Box addresses are not permitted.

Step 18: Complete the Beneficial Owner(s) tab. Complete all required red asterisk (*) fields under the Beneficial Owner(s) tab. (3 of 3)

Enter required information about the beneficial owner’s identification document under the Form of Identification and Issuing Jurisdiction section. You will also need to attach an image of an acceptable identifying document for the beneficial owner. The image must be complete, clear and readable image of the page/side of the identifying document containing the unique identifying number and other identifying data. Only 1 file with a maximum file size of 4MB may be attached. Supported formats: JPG, JPEG, PNG, and PDF.

Step 19: Add additional Beneficial Owners by click the Add Beneficial Owner button.

Repeat steps 16-18 for each beneficial owner that meets the previously discussed reporting requirements.

To remove a beneficial owner, click the Remove Beneficial Owner button.

There is no limit to the number of beneficial owners that can be reported on a paper filing; however, to e-file the number of beneficial owners is limited to 99.

Once all beneficial owners’ information is entered, click Next or navigate to the final Submit tab.

Step 20: Review the Form. Under the Submit tab, complete all required red asterisk (*) fields.

Select the I agree checkbox indicating that you certify that all information is true, correct and complete. Agreeing to this certification validate all fields.

If you have any required fields that are missing or contain invalid entries, an error message will display. The I agree checkbox will remain unselected, and you will need to fix any errors before selecting I agree again.

Step 21: Check the I am human box on the hCaptcha and complete the required verification to prove you are not a robot.

Step 22: Click Submit BOIR!

After Submission

Once you have submitted the BOIR DO NOT CLOSE THE SUBMISSION PAGE! The BOI E-Filing System will display a progress bar and Submission Tracking ID. Copy the Submission Tracking ID for your records, then wait for the progress bar to fil completely.

Once the submission is processed successfully, you will see the Submission Status Confirmation page. Your submission has not been processed until you see this confirmation.

Be sure to click the Download Transcript button to download a PDF copy of the transcript which will include the confirmation page details and the report data in transcript format. Retain this for your records as it serves as a receipt of your submission.

For more detailed information please see the BOI Step-by-Step Instructions guide published by the Federal Crimes Enforcement Network. A link to this guide is included at the end of this document.

Updated or Corrected Reports

For information on how to process an updated or correct a previously filed report please see Section 7 of the BOI Step-by-Step Instructions guide. A link to this guide is included at the end of this document.

Failing to File

The willful failure to report complete or updated beneficial ownership information to FinCEN, or the willful provision of or attempt to provide false or fraudulent beneficial ownership information may result in a civil or criminal penalty, including civil penalties of up to $500 for each day that the violation continues, or criminal penalties including imprisonment for up to 2 years and/or a fine of up to $10,000. Senior officers of an entity that fail to file a required BOI report may be held accountable for that failure.

Additionally, a person may be subject to civil and/or criminal penalties for willfully causing a company not to file a required BOI report or to report incomplete or false beneficial ownership information to FinCEN.

Disclaimer – This is for informational purposes only. Compliance with the Corporate Transparency Act and BOI reporting obligation is the responsibility of the reporting company. The information provided is not legal advice nor is it a substitute for legal advice from a licensed attorney in your state relating to reporting obligations, beneficial owner analysis or other assistance relating to the Act, BOI reporting or compliance.

Links to Helpful Resources: